Подстрижем вашего питомца красиво, бережно, недорого!

Работаем с любой породой

Не используем наркоз и седативные препараты

Работают профессионалы

УСЛУГИ И ЦЕНЫ

СТРИГУЩИЕСЯ ПОРОДЫ

Порода Собаки

Йоркширский терьер

Бивер йорк

Шпиц мини до 30см.

Шпиц средний до 40см.

Белый японский шпиц

Шпиц большой до 50см.

Вольфшпиц (Кеесхонд)

Мальтезе

Ши-тцу

Пекинес

Бишон фризе

Той Пудель

Карликовый Пудель

Малый Пудель

Большой Пудель

Мальтипу

Кавапу

Лабрадудль

Керри-блю-терьер

Китайская хохлатая голая

Китайская хохлатая пуховая

Английский кокер-спаниель

Американский кокер-спаниель

Стрижка + Комплексный уход

2000р.

2000р.

2200р.

2400р.

2500р.

2700р.

2700р.

2000р.

2200р.

2000р.

2800р.

2200р.

2400р.

2600р.

3800р.

2300р.

2600р.

3500р.

4000р.

1800р.

2200р.

3000р.

3000р.

Гигиенический Комплекс

1300р.

1300р.

1500р.

1700р.

1800р.

2000р.

2000р.

1500р.

1500р.

1500р.

2000р.

1500р.

1700р.

1900р.

2800р.

1500р.

1800р.

3000р.

2500р.

1300р.

1600р.

2000р.

2000р.

Порода / Комплекс / Гигиена

Йоркширский терьер / 2000р. / 1300р.

Бивер йорк / 2000p. / 1300p.

Шпиц мини до 30см. / 2200p. / 1500p.

Шпиц средний до 40см. / 2400p. / 1700p.

Белый японский шпиц / 2500p. / 1800p.

Шпиц большой до 50см. / 2700p. / 1800p.

Вольфшпиц (Кеесхонд) / 2700p. / 2000p.

Мальтезе / 2000p. / 1500p.

Ши-тцу / 2200p. / 1500p.

Пекинес / 2000p. / 1500p.

Бишон фризе / 2800p. / 2000p.

Той пудель / 2200p. / 1500p.

Карликовый пудель / 2400p. / 1700p.

Малый пудель / 2600p. / 1800p.

Большой пудель / 3800p. / 2800p.

Мальтипу / 2300p. / 1500p.

Кавапу / 2600p. / 1800p.

Лабрадудль / 3500p. / 2500p.

Керри-блю-терьер / 4000p. /2500p.

Китайская хохлатая голая / 1800p./ 1300p.

Китайская хохлатая пуховая/2200p./1600p.

Английский кокер-спаниель/3000p./2000p.

Американский кокер-cпаниель/3000p./2000p.

Комплексный уход включает в себя: купание, чистку ушей, глаз, выбривание подушечек лап и зоны гениталий (у тех пород, где это допускается), стрижку коготков.

Гигиенический комплекс включает в себя: купание, чистку ушей, глаз, выбривание подушечек лап и зоны гениталий (у тех пород, где это допускается), стрижку коготков и окантовку лапок и ушей.

ТРИММИНГУЕМЫЕ ПОРОДЫ

Порода Собаки

Джек-рассел-терьер

Вест-хайленд-уайт-терьер

Цвергшнауцер

Миттельшнауцер

Ризеншнауцер

Скотч-терьер

Брюссельский грифон

Фокстерьер

Вельштерьер

Эрдельтерьер

Такса стандартная

Такса миниатюрная

Такса кроличья

Триминг + Комплексный уход

2100р.

3300р.

3300р.

4300р.

6300р.

3300р.

2000р.

4300р.

4300р.

5000р.

2000р.

1900р.

1800р.

Стрижка + Комплексный уход

1800р.

2500р.

2500р.

3500р.

5500р.

2500р.

1500р.

3000р.

3000р.

4000р.

1500р.

1300р.

1300р.

Порода / Тримминг / Стрижка

Джек-рассел-терьер / 2100p. / 1800p.

Вест-хайленд-уайт-терьер / 3300p. /2500p.

Цвергшнауцер / 3300p. / 2500p.

Миттельшнуцер / 4300p. / 3500p.

Ризеншнауцер / 6300p. /5500p.

Скотч-терьер / 3300p. / 2500p.

Брюссельский грифон / 2000p. / 1500p.

Фокстерьер / 4300p. / 3000p.

Вельштерьер / 4300p. / 3000p.

Эрдельтерьер / 5000p. / 4000p.

Такса стандартная / 2000p. / 1500p.

Такса миниатюрная / 1800p. / 13600p.

Такса кроличья / 1800p. / 1300p.

Комплексный уход включает в себя: купание, чистку ушей, глаз, выбривание подушечек лап и зоны гениталий (у тех пород, где это допускается), стрижку коготков.

ЭКСПРЕСС ЛИНЬКА

Вычес линяющей шерсти + гигиенический комплекс с использованием косметики, облегчающей линьку.

Порода Собаки

Чихуахуа

Той-терьер

Мопс

Французский бульдог

Джек-рассел-терьер

Карликовый пинчер

Бигль

Сиба ину

Вельш-корги

Далматин

Лабрадор

Хаски

Колли

Шелти

Австралийская овчарка

Акита ину

Золотистый ретривер

Немецкая овчарка

Ротвейлер

Доберман

Боксер

Самоедская лайка

Чау-чау

Цена

1700р.

1700р.

2000р.

2200р.

2200р.

2000р.

2300р.

2600р.

2600р.

3000р.

3800р.

4300р.

4300p.

2800р.

4300р.

4500р.

4500р.

4000р.

3800р.

3600р.

3500р.

5000р.

5500р.

Порода / Цена

Чихуахуа / 1700p.

Той-терьер / 1700p.

Мопс / 2200p.

Французский бульдог / 2200p.

Джек-рассел-терьер / 2200p.

Карликовый пинчер / 2000p.

Бигль / 2300p.

Сиба ину / 2600p.

Вельш-корги / 2600p.

Далматин / 3000p.

Лабрадор / 3800p.

Хаски / 4300p.

Колли / 4300p.

Шелти / 2800p.

Австралийская овчарка / 4300p.

Акита ину / 4500p.

Золотистый ретривер/4500p.

Немецкая овчарка /4000p.

Ротвейлер / 3800p.

Доберман / 3600p.

Боксер / 3500p.

Самоедская лайка / 5000p.

Чау-чау / 5500p.

КОШКИ

Услуга

Стрижка кошки

Гигиенический комплекс кошки

Комплекс со стрижкой для кошки

Стрижка Мейн куна

Гигиенический комплекс Мейн куна

Комплекс со стрижкой для Мейн куна

Цена

2000р.

2500р.

2500р.

2500р.

3000р.

3000р.

Услуга / Цена

Стрижка кошки / 2000p.

Гигиенический комплекс кошки / 2500р.

Комплекс со стрижкой для кошки / 2500p.

Стрижка Мейн куна / 2500p.

Гигиенический комплекс Мейн куна / 3000p.

Комплекс со стрижкой для Мейн куна / 3000p.

Гигиенической комплекс для кошки включает в себя: купание, высушивание, вычесывание, чистку ушей, подстригание коготков.

Комплекс со стрижкой для кошки включает в себя: стрижку, купание, высушивание, вычесывание, чистку ушей, подстригание коготков.

Подстригание коготков идет в подарок к любой услуге для кошек.

КРЕАТИВНЫЙ ГРУМИНГ

Услуга

Выбривание узора “Шиншилла”

Выбривание узора “Ананас”

Окрашивание хвоста в яркий цвет

Блеск тату

Украшение стразами

Цена

300р.

300р.

500р.

200р.

от 100р.

Услуга / Цена

Выбривание узоро “Шиншилла” / 300p.

Выбривание узора “Ананас” / 300p.

Окрашивание хвоста в яркий цвет / 500p.

Блеск тату / 200p.

Украшение стразами / от 100р.

ДОПОЛНИТЕЛЬНЫЕ УСЛУГИ

Услуга

Ультразвуковая чистка зубов (без наркоза)

Подстригание коготков с подпиливанием.

Распутывание колтунов

Чистка параанальных желез

Обработка от блох

Цена

от 1500р.

от 200р.

300р.

300р.

200р.

Услуга / Цена

Ультразвуковая чистка зубов (без наркоза) / от 1500р.

Подстригание коготков с подпиливанием / от 200р.

Распутывание колтунов / 300p.

Чистка параанальных желез / 300p.

Обработка от блох / 200p.

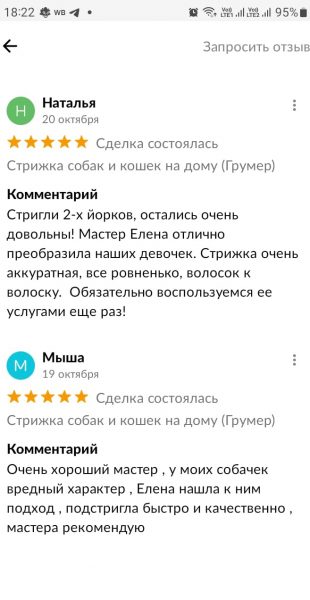

ОТЗЫВЫ

КОНТАКТЫ

ЗООСАЛОН “ДЭНДИ”

DANDYGROOM.RU

г.Москва

метро Щукинская или Октябрьское поле

ул.Живописная 24 (вход со двора)

работаем с 9.30 до 20.00

тел: +7 925 299 02 02